Loan life cycle

automation

Entire front-to-back solution ready today

- Automated decision making and business processes management bring efficiency, compliancy and confidence

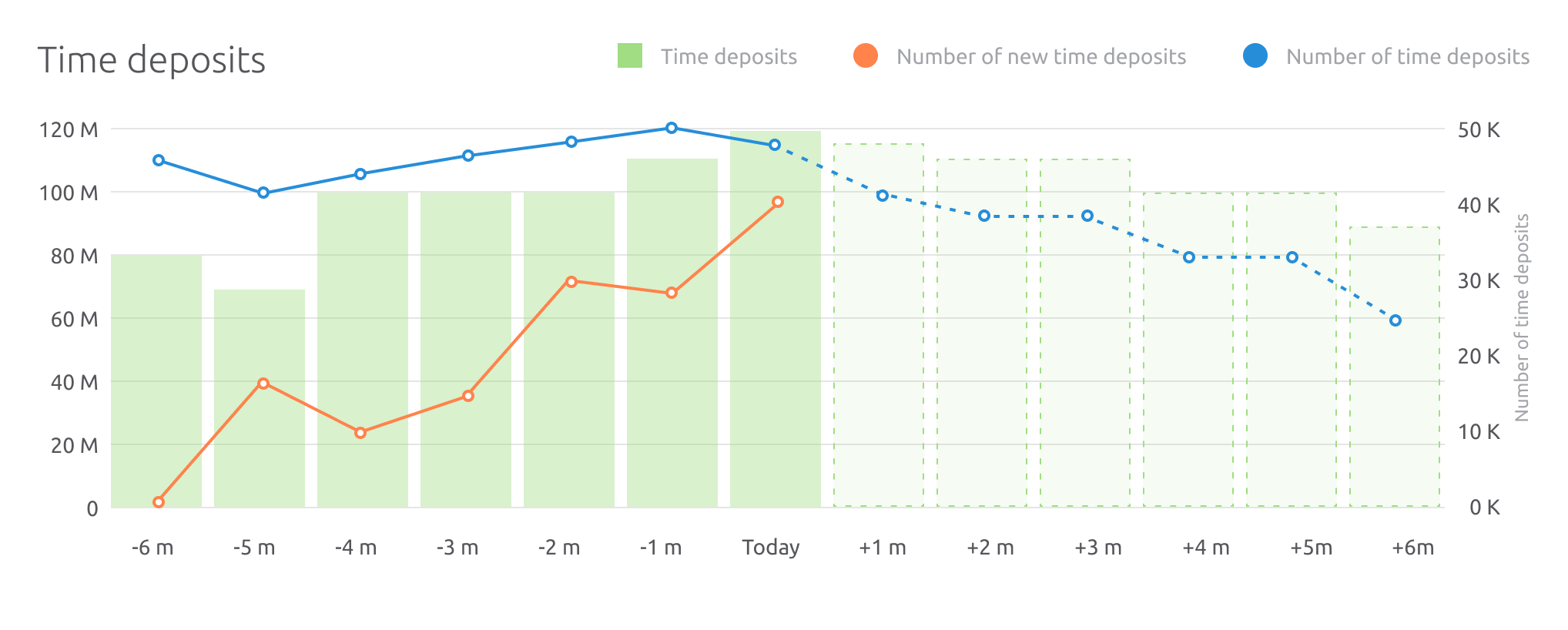

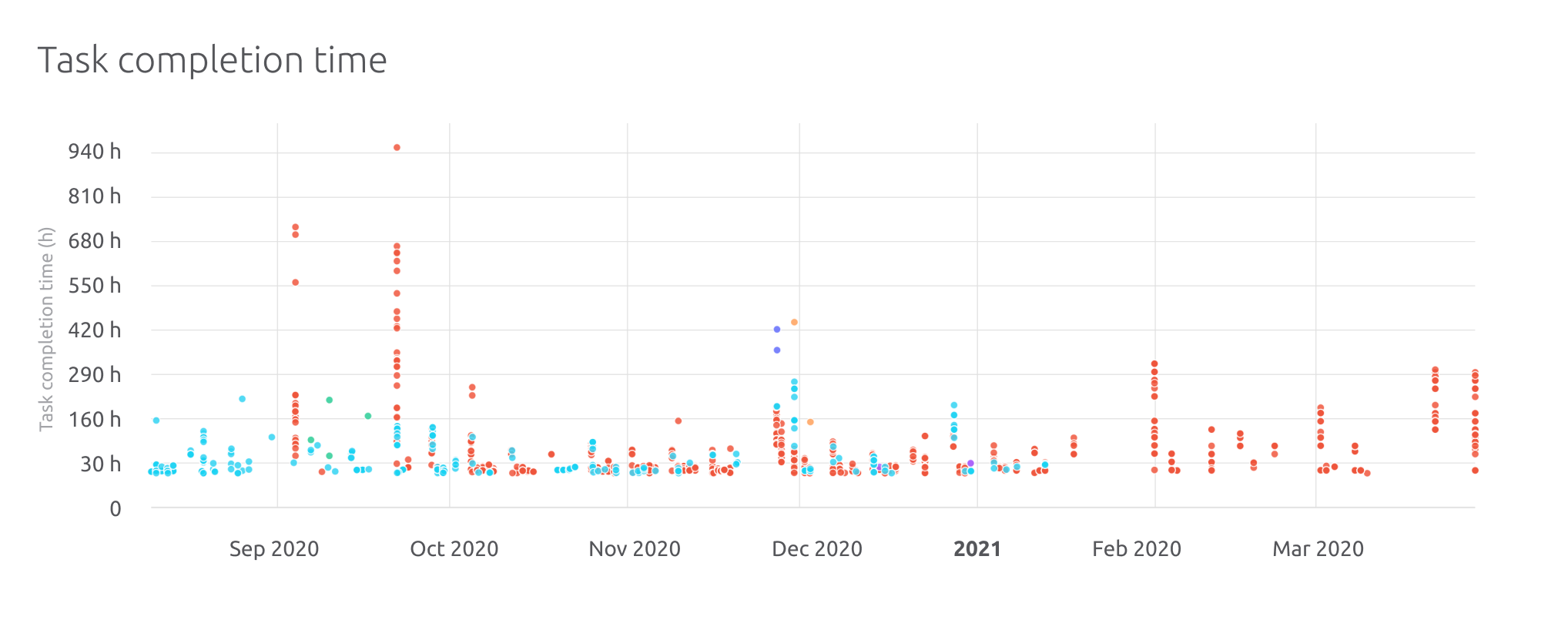

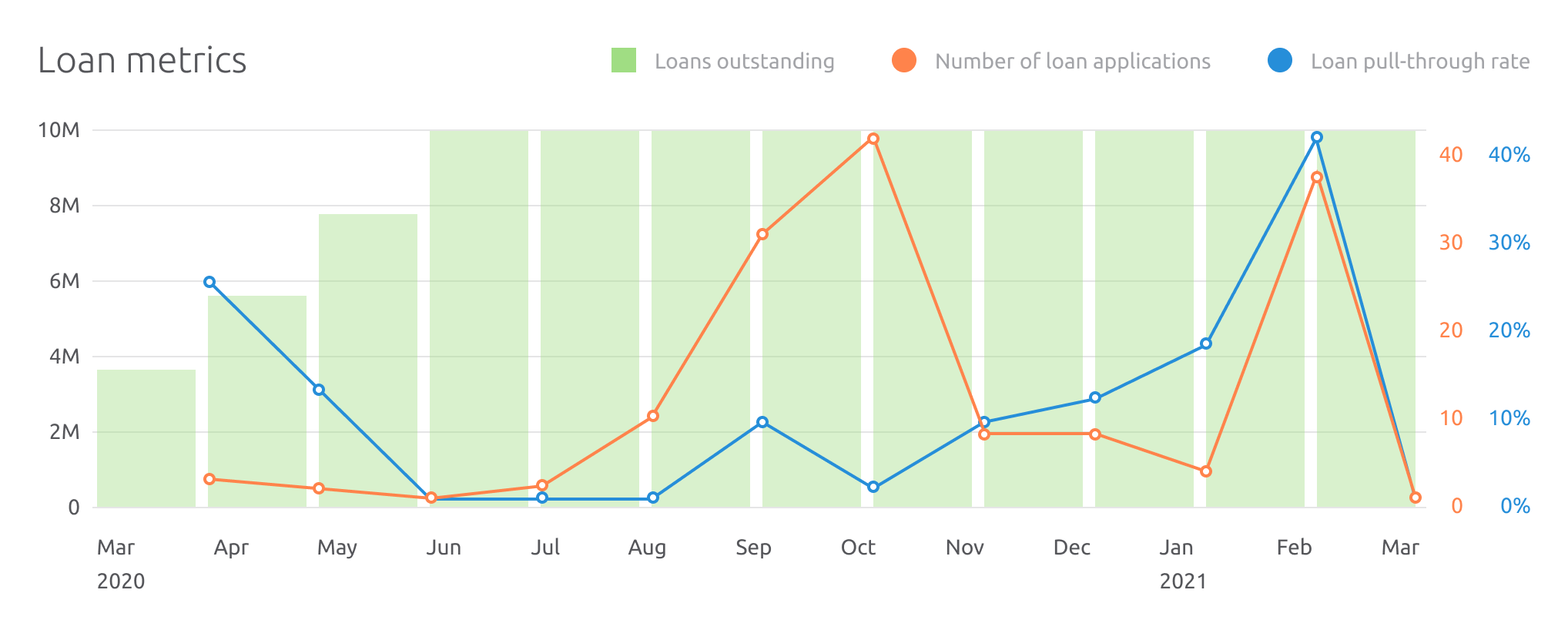

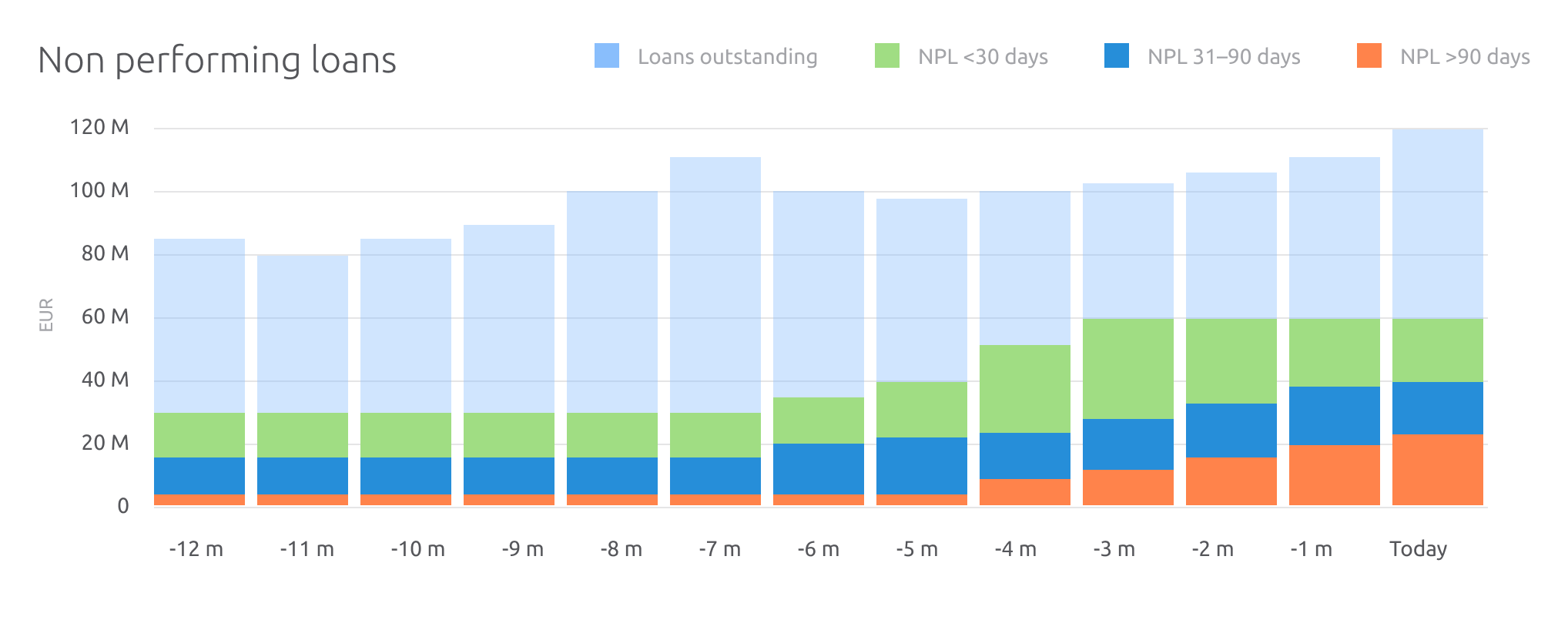

- Reports and business dashboards lead you into a great future

SSL encryption

SSL encryption GDPR Compliance

GDPR Compliance 2 factor authentication

2 factor authentication Anti-fraud, sanctions, PEP measures

Anti-fraud, sanctions, PEP measures Financial inspection ready

Financial inspection ready |

Alternative | |

|---|---|---|

| In production over 7a |  |

|

| Mature and secure |  |

|

| Uptime 99.8% |  |

|

| GDPR compliant |  |

|

| Meeting financial regulations |  |

|

| Change of processflows without IT |  |

|

| You can delegate responsibility to us |  |

|

| On-call daily support |  |

|

| Changes of decisions engine rules without IT |  |

|

| Experinced team members overs 25a of expertise available |  |

|

| Hosting, backup, monitoring, contingency |  |